Let us explore the Top 10 AI ETFs to buy in 2023. It is understandable that individual stocks may be too risky for some, so ETFs offer a diverse range of companies to promote growth while minimizing risk.

Please note that some ETFs you believe is a better AI choice may have been overlooked. If so, kindly share it in the comments below for others to see. In selecting these top AI ETFs, a careful observation has been made to choose distinct options and prioritized those with lower expense ratios in cases of near-identical offerings.

Roundhill Ball Metaverse ETF

The Roundhill Ball Metaverse ETF offers exposure to companies involved in defining the metaverse, creating entertainment within it, and providing infrastructure for its development. Despite the term “metaverse” being lackluster for investment, this ETF consists of strong companies that contribute to AI and infrastructure.

The ETF heavily relies on NVIDIA, a powerhouse in graphics card design with partnerships with Microsoft for AI-powered virtual machines and Amazon’s AWS for machine learning solutions. Unlike typical technology ETFs featuring Apple and Microsoft as top holdings, this fund includes diverse companies like Roblox, Tencent, and Sony from gaming and entertainment sectors.

Having been around for only two years, the Roundhill Ball Metaverse ETF has a year-to-date performance of 27.8%. With 52 total holdings and an expense ratio of 0.59%, it is less diverse than other funds discussed here. This choice is riskier due to its limited diversity; however, it provides unique top-10 holdings compared to most tech ETFs.

iShares US Tech Breakthrough Multisector ETF

The iShares US Tech Breakthrough Multi-Sector ETF is next on the list, focusing on investing in US companies working on technological breakthroughs in robotics, AI, cloud computing, cybersecurity, financial services and genomics. This broad strategy covers the key sectors that are poised to benefit most from AI and major tech advancements.

Among its top 10 holdings are Salesforce and Regeneron Pharmaceuticals. Salesforce specializes in CRM software with over 20% market share and has been offering AI solutions under the name “Salesforce Einstein” for several years now. As AI becomes increasingly pervasive today, this company will likely attract more clients.

Regeneron Pharmaceuticals also shows great potential due to its use of AI. Their website highlights massive improvements in dataset analysis and faster data review pipelines through machine learning adoption. This accelerates potential therapies’ development and increases productivity tenfold – bringing us closer to finding cures for severe diseases.

In terms of performance, this ETF has a year-to-date return of 21.7%, holding a total of 184 companies – making it reasonably diverse. Its expense ratio is below average at just 0.4%. While similar to Global X’s AI & Technology ETF (AIQ), iShare’s ETF is chosen due to its significantly lower expense ratio by 28 basis points.

Global X Robotics and AI ETF

The third ETF under consideration is the Global X Robotics and AI ETF, which focuses on investments in AI, automation, and industrial robotics. Its top 10 holdings are quite unique, with Intuitive Surgical as the leading company. This firm develops automated solutions and robots for the medical sector, including full surgical systems like DaVinci that offer robot-assisted technology to enhance precision and efficiency in surgeries.

In terms of performance, this fund has a year-to-date return of 23.9% and holds a total of 298 companies, making it the most diverse among all ETFs discussed here. It carries an expense ratio of 0.69%. Two appealing features of this ETF include its global set of holdings providing an international mix and its large subset of holdings offering added diversity – both desirable aspects for a globally-inclusive fund.

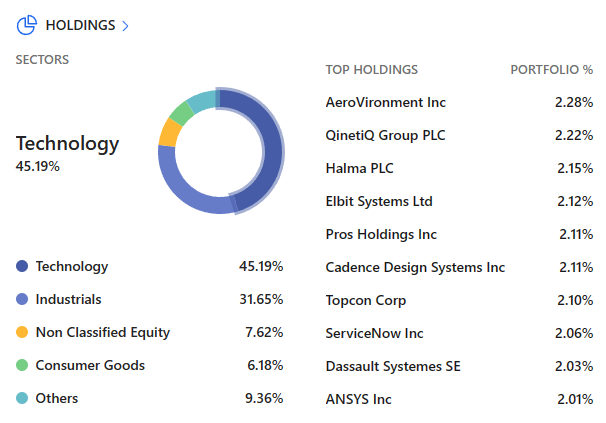

First Trust NASDAQ Artificial Intelligence and Robotics ETF

The fourth ETF is the First Trust Nasdaq Artificial Intelligence and Robotics ETF. Among its top 10 holdings are several leading defense companies that may not be familiar to many investors.

One of these top holdings is AeroVironment, a company that develops autonomous drones and weapons systems. Their products have become well-known in recent years, and demand for such systems is expected to grow over time. Another key holding is Kinetic, which produces ground-based robotics for the defense sector.

It’s worth noting that some people may not wish to invest in defense companies, which is entirely understandable. However, this ETF showcases multiple sectors to provide diverse investment options. With a year-to-date performance of 14.2%, it has the lowest return among the ETFs reviewed here but holds 113 companies with an expense ratio of 0.65%.

Two appealing aspects of this ETF include: first, its unique selection of AI-focused companies that differ from major tech firms; secondly, its coverage of less common sectors compared to other ETFs.

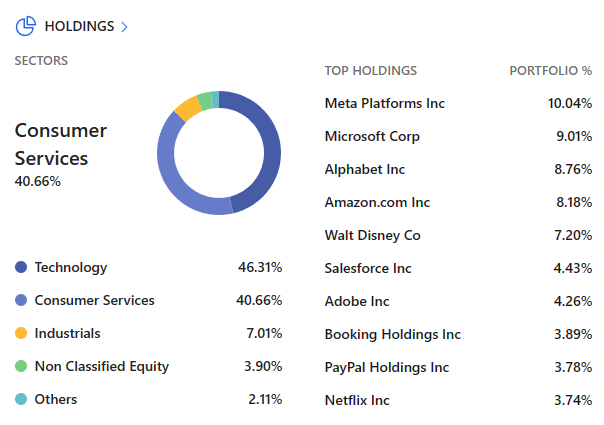

Invesco NASDAQ Internet ETF

The fifth ETF Invesco Nasdaq Internet ETF features top AI players like Meta, Google, Microsoft, and Amazon. With the largest percentage of Meta and Amazon in its top 10 holdings among the covered ETFs, it offers a promising AI portfolio.

Meta has been heavily investing in AI for its ads platform and social network reels, resulting in increased profits in Q1 this year. Meanwhile, Amazon is utilizing AI to develop tools like Code Whisperer to help programmers write code efficiently. Furthermore, their AWS program Bedrock provides billion-dollar AI models for customers to create custom AI tools and analytics.

This fund comprises major tech companies set to capitalize on the growing AI market over the next decade. It has a year-to-date performance of 24.9%, with 85 companies held at an expense ratio of only 0.6%. The top 50% of holdings are spread across seven different companies without including Apple—a refreshing composition for an AI-focused fund.

Invesco QQQ Trust Series 1 ETF

The Invesco QQQ Trust Series 1 ETF is the sixth fund on the list. Despite its heavy marketing, it’s a solid choice due to its focus on high-tech companies with strong AI growth potential. The ETF has delivered a year-to-date performance of 23.8% across 102 companies and boasts an expense ratio of just 0.2%. This low fee structure, combined with consistent performance, makes it stand out among other funds under review.

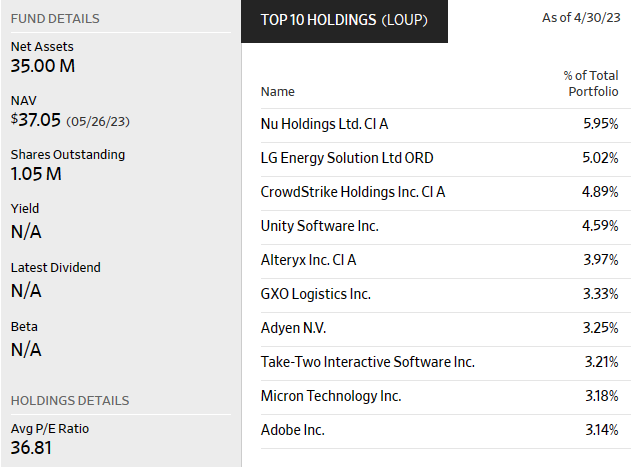

Innovator Deepwater Frontier Tech ETF

The Deepwater Frontier Tech ETF aims to identify emerging companies with potential breakthroughs in robotics and AI, resulting in a unique top 10 holdings compared to other ETFs covered here. Some of these holdings include controversial gaming companies, which may carry higher risk. The year-to-date performance stands at 18.3% across 113 total companies, but it has the highest expense ratio of 0.7%.

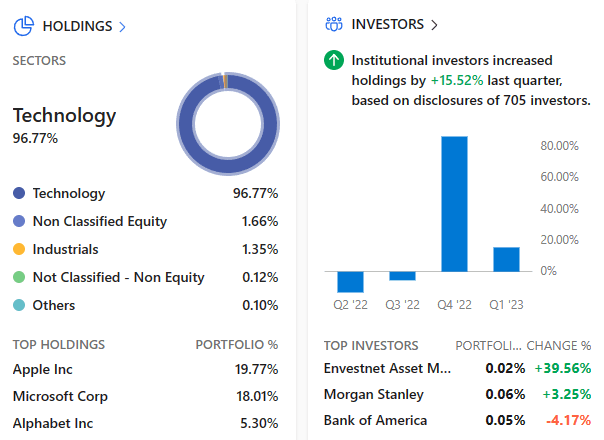

iShares Global Tech ETF

The iShares Global Tech ETF is the eighth option, with almost 50% of its holdings in Apple and Microsoft, making it a rather vanilla fund. However, the inclusion of ASML Holdings and Taiwan Semiconductor in the top list is appealing due to their potential for AI growth.

ASML Holdings, a Dutch company producing extreme ultraviolet lithography machines, enables chip manufacturers to increase capacity while reducing size. As one of the few companies manufacturing these machines and with chip makers like Nvidia experiencing significant growth alongside recent legislation promoting domestic chip production in the United States, EUV equipment will likely be in high demand for years to come.

This ETF has shown strong performance at 23.7% year-to-date across 114 companies and boasts a low expense ratio of just 0.4%.

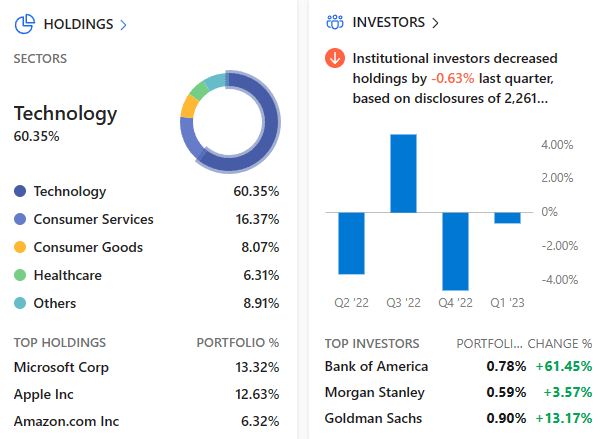

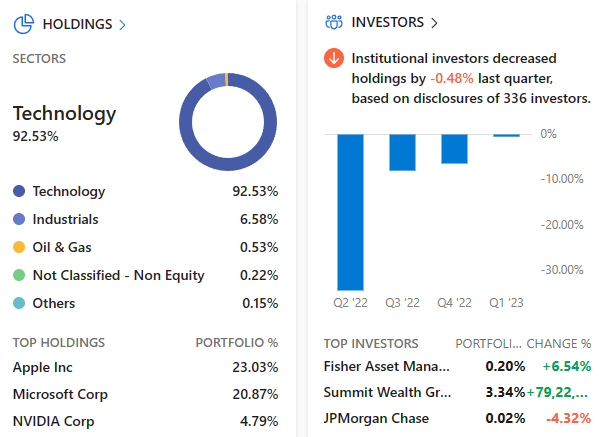

iShares US Technology ETF

The ninth pick iShares US technology ETF is an excellent foundational choice for AI investments. Its top holdings include Microsoft, Alphabet (parent company of Google), NVIDIA, and Meta.

Alphabet has been integrating AI into various services such as search, photos, maps, and translation. They recently introduced their PaLM 2 AI model which excels in math, coding, and language translation. Additionally, they plan to expand their chatbot Bard to compete with GPT-based chatbots.

This ETF boasts the highest year-to-date performance among all mentioned in the list with a 29.3% increase across its 139 companies. It also offers a low expense ratio of 0.39%. Furthermore, it has a proven track record with a five-year return of 17.9%. Overall, this workhorse ETF promises strong AI coverage that should perform well over the next decade.

Technology Select Sector SPDR Fund

The last ETF is the Technology Select Sector SPDR Fund. This fund, heavy in Apple and Microsoft, also has a diverse spread of Nvidia, Salesforce, Adobe, and Oracle. It made in the list due to its excellent management over several years.

The year-to-date performance shows an impressive 24.2% increase across just 66 companies. What sets it apart is its low expense ratio of 0.1%, making it more cost-effective than any other fund on this list. While its performance may not be the highest for this year alone, it boasts the best five-year return at 19.5%.

This well-managed ETF proves to be a solid choice for investing in the AI space with strong long-term results and a favorable expense ratio.

One thought on “Top 10 AI ETFs to buy in 2023: Once in a Lifetime Opportunity”

Comments are closed.