Overview

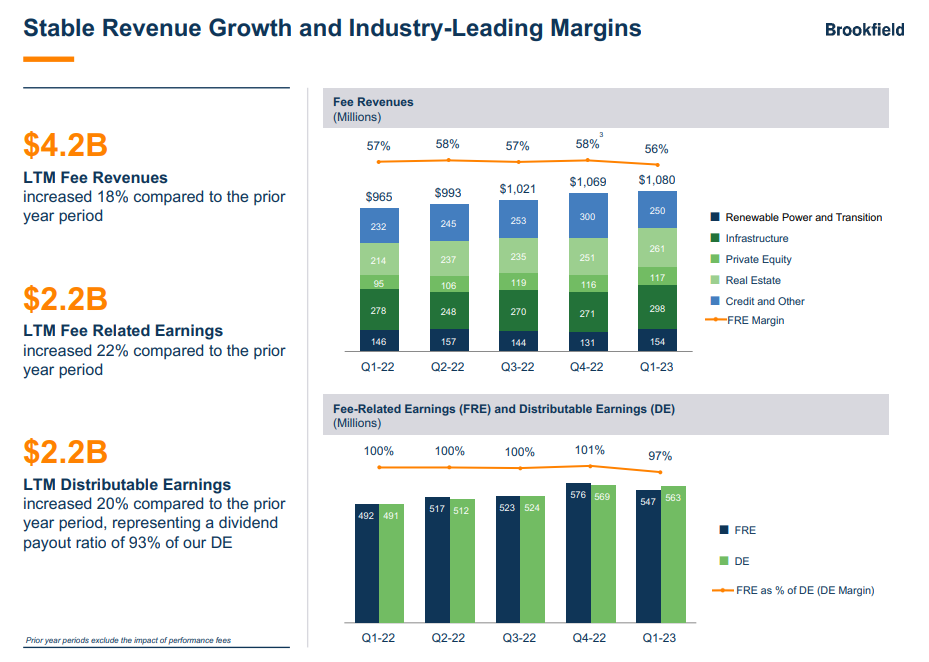

Brookfield Asset Management is currently one of the top dividend growth stocks in the market. The company recently reported its first quarter 2023 earnings, showcasing 15% growth and distributable earnings of $563 million. To date, Brookfield has raised $19 billion in capital.

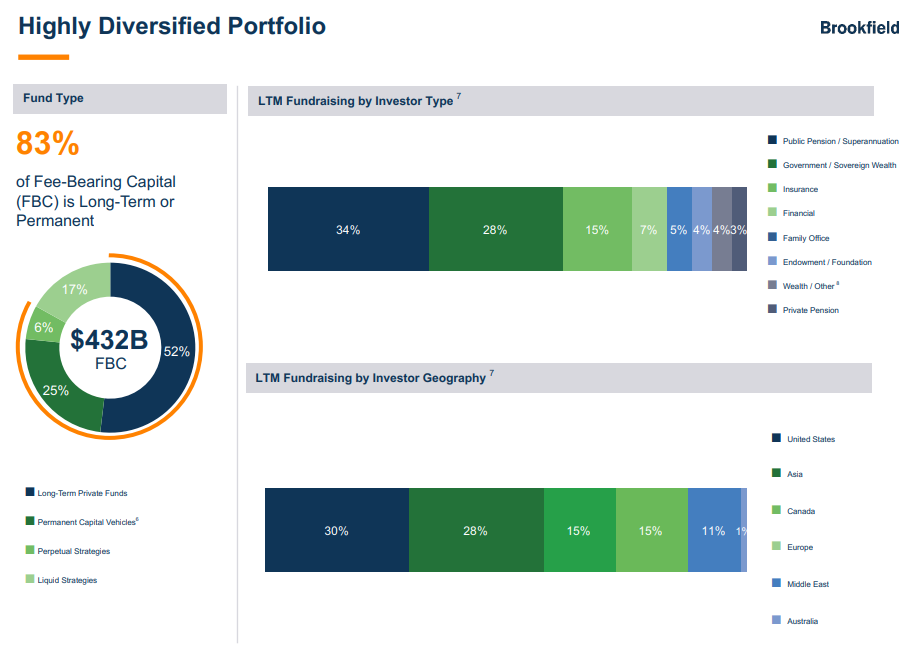

The company’s primary function is to raise money from investors and manage their capital. In return, it earns management fees on this capital, which helps grow revenues and cash flows. Over the past year, it raised $98 billion and currently manages $432 billion fee-bearing capital.

What sets Brookfield Asset Management (BAM) apart is its clean balance sheet with $3.2 billion in cash and no debt. This financial stability makes it more appealing to investors compared to its parent company, Brookfield Corporation (BN).

In summary, Brookfield Asset Management’s strong performance, clear business model, and solid financial standing make it an attractive dividend growth stock at fair value today.

Brookfield’s Diverse Revenue Growth and Real Estate Expansion

The report highlights the company’s revenue sources, including segments such as renewable power and transition, infrastructure, private equity, real estate, credit, and others. All these sectors are experiencing growth.

Remarkably, the real estate segment has grown by approximately 20% year over year. This indicates that despite a downturn in the market overall, Brookfield Asset Management continues to expand its real estate business by investing more capital in this sector. The consistent growth across all areas of the business serves as a strong indicator of its success.

Brookfield’s Diverse Fundraising and Asian Growth

Brookfield Asset Management’s fundraising has become increasingly diverse in terms of geographical sources. Currently, 30% of their funds come from the United States, 28% from Asia, 15% from Canada, 15% from Europe, 11% from the Middle East, and a mere 1% from Australia.

This indicates that the company is no longer heavily reliant on funding from the United States. The significant amount of funding received from Asia is particularly noteworthy as their Asian business continues to grow. This growth is a positive sign since much of the world’s economic expansion over the next two to three decades is expected to originate in Asia.

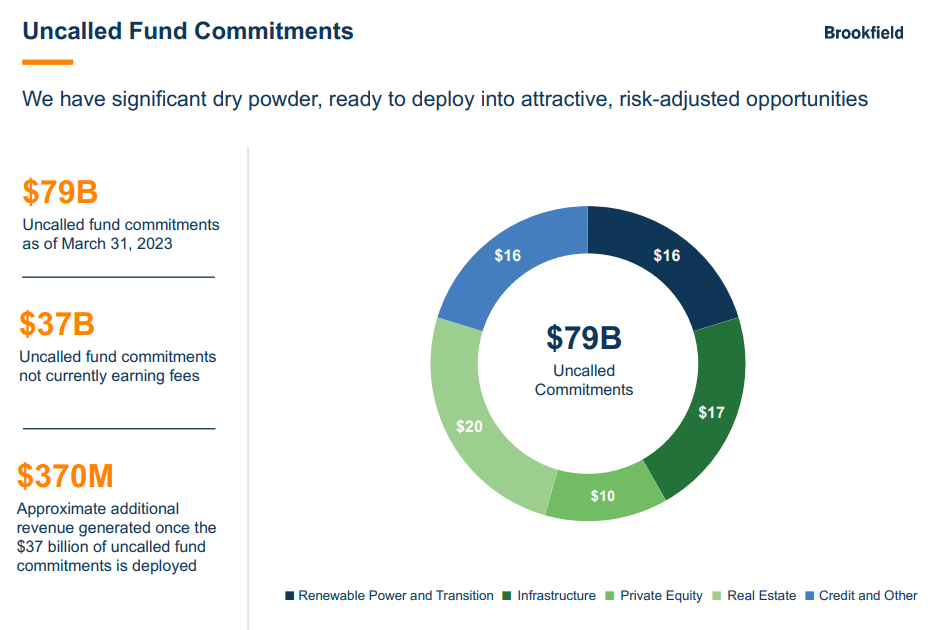

Brookfield’s Capital Advantage – Dry Powder

Brookfield Asset Management currently possesses a significant amount of dry powder, with $79 billion in uncalled commitments. This means they have not yet deployed the committed capital from their investors. As interest rates rise and asset prices decline, particularly in real estate and debt sectors, Brookfield can deploy this capital at more attractive prices and returns.

With the overall economy weakening, they are able to acquire businesses at lower costs, including private acquisitions and public stock market investments during downturns. Once these funds are deployed, Brookfield expects an additional $370 million in revenue for the business. This will significantly contribute to the company’s cash flow.

Company’s Strong Financial Position

The company’s report reveals a clean balance sheet with $12 million in cash and cash equivalents, $2.4 million in investments, $875 million due from affiliates, and a total of $3.3 billion in assets. In terms of liabilities, there are $873 million in accounts payable and $100 million due to affiliates, resulting in total liabilities of $973 million.

An analysis of the company’s liquid assets shows that they amount to approximately $2.4 billion – over double the value of their total liabilities. This strong financial position is evident throughout their balance sheet, indicating that they have more cash than liabilities and are a financially sound company.

Brookfield’s Strategy: Private Equity and Real Estate Opportunities

“The current market environment has accelerated growth opportunities with a particular focus on take private opportunities.”

“We have not seen markets like this for a while. This is a significant opportunity for our distressed debt franchise, and likely also our private equity funds and real estate funds.”

“Our business usually excels in periods such as now and this presents great opportunities for us.”

Brookfield Asset Management transcripts reveal valuable information, particularly regarding their $79 billion cash reserve and focus on private equity deals. This involves buying public companies and taking them private under Brookfield Corporation. They also anticipate opportunities in the real estate sector.

Despite bearish sentiments on office real estate, which has impacted Brookfield’s stock recovery, the company maintains that 95% of its properties are high quality. The remaining 5%, garnering negative headlines due to defaults and poor quality, only represents 0.4% of their portfolio. In contrast, the other 99.6% is performing well with record occupancy rates and operating income growth.

Capitalizing on depressed real estate prices while others remain bearish, Brookfield plans to acquire high-quality properties at discounted rates for attractive returns. As value investors at heart, they will continue seeking opportunities amid market distresses.

Brookfield Optimistic Amid Weak Sector Projections – Diverse Assets and Global Relationships

A question coming from one of the analysts on the call asks Bruce who is the CEO of Brookfield.

“Bruce, you are striking a very different tone on fundraising than what we’ve heard, I think from a lot of the other alternative asset management space players in this space, with a generally softer tone from most. It doesn’t sound like it’s impacting your business guys as much, so a couple of questions on that. I guess, one, over the course of the quarter, you talked about — I think, about a $100 billion fundraising opportunity you see for Brookfield over the course of 2023.

If that’s the case, maybe just expand a little bit what gives you confidence you could get there? And with respect to your comments around geographic fundraising efforts, with Middle East and Asia comprising a sizable part of the fundraise so far this year, maybe talk a little bit about the differences you see in the market between those players versus North America and Europe?”

The analyst on the call is basically asking Brookfield’s CEO, Bruce, about their optimistic projections despite other asset managers anticipating a softer year for fundraising and overall business. While others predict weaker performance, Brookfield projects 15% growth in cash flow this year.

The analyst wants to know what sets them apart and how they plan to achieve such growth amid a weak sector.

Here is a Brookfield’s response and this is from the president of Brookfield first and then Bruce responds after and they say –

“Our business is incredibly diversified first by product offering. And we are very, very fortunate that, as you said, although the fundraising environment is perhaps a little softer today than it has been in the past, we are fortunate that we are overexposed to the asset classes that are of greatest interest to investors. And many of our funds are resonating with our clients, and this environment really plays to our strengths for many of our strategies, so the diversity of our product offering and our overweight towards the sectors of most interest puts us in a very fortunate position.”

Brookfield highlights their diverse product offerings, including infrastructure, real estate, renewables, debt, insurance and more. These asset classes are currently in high demand among large fund investors.

As a result of offering these sought-after investment vehicles, Brookfield continues to receive substantial funds from its investors.

“And then, secondly, it’s the diversity of our client base. We are very fortunate in that; we have great operating and client and partner relationships all over the world. Obviously huge relationships in North America, but also across all major Middle Eastern countries. We’ve got significant relationships across the entirety of Asia.”

“And therefore, while certain types of investors may be positioning or may be feeling certain headwinds, other types of our investors, whether it would be – whether they be differentiated by their geography or their investor type, they’re actually seeing tremendous tailwinds.”

So, Brookfield’s investors are seeing tailwinds right now where a lot of other asset managers are seeing headwinds from their clients.

Bruce Flatt then chimes in here and he says “I think our business is a little different, because we’ve invested into all of these countries and we have large, large businesses in countries running operating businesses in the countries; in India, Australia, Korea, Japan, China, Saudi Arabia, Qatar, Dubai, Abu Dhabi. And therefore, our relationships are both locally with our different regional businesses, and they just tend to be different and not just about fundraising.”

Bruce Flatt is basically saying that they not only manage assets for investor funds in various countries but also own operating businesses there. Their deep relationships with these countries and clients serve as their differentiating factor.

Brookfield’s Digital Infrastructure Investment Strategy

The following transcript talks about the different areas that Brookfield is investing its money and really where it is seeing opportunities over the coming decades.

“We’re off to an amazing start in 2023, having already committed and/or deployed to more than $15 billion of investments.”

This means that Brookfield is deploying tens of billions of dollars already so far in the year.

“There is a once-in-a-generation market opportunity to fund an unprecedented build-out of new infrastructure assets… You may have heard us speak before about the infrastructure super cycle that is unfolding today.”

“First, Digitalization. This refers to the infrastructure investment opportunities that are derived from the exponential increase in data consumption. Data is still the world’s fastest-growing commodity. Based on current usage patterns, the amount of data that is generated globally is expected to double over the next 18 to 24 months, and this pace is only going to continue to accelerate.”

“All this data needs to be transported, processed, and stored. We are already seeing the market opportunity playing out across three verticals, fiber networks, wireless power networks and data centers.”

The transcript discusses Brookfield’s investment strategy and highlights the opportunities it sees in the coming decades. The company believes that the ongoing digitization of the world will require a significant infrastructure investment, including new wires, wireless power networks, and data centers.

Focusing on this area, Brookfield Infrastructure is investing in data centers globally to support the transition towards a digital economy. They anticipate that this trend will continue to accelerate, presenting a massive opportunity for their business.

Renewable Power, Digitization, and De-globalization Trends

Now the next transcript says, “it is estimated that 10,000 megawatts of new datacenter capacity will be required in the next decade. With the growth of AI, which utilizes exponentially more data and requires significantly more computing power, we expect demand to only accelerate from here.”

“The next theme is Decarbonization.”

“This is an opportunity for our renewable power and transition business, and they are investing in this opportunity heavily.”

“And the third theme we wanted to touch on is Deglobalization.”

“A great example of this is our $15 billion investment in one of Intel’s semiconductor fabrication facilities, which is currently under construction in Arizona.”

“On the other hand, lower-value goods such as apparel, furniture, or household items continue to be manufactured in lower-cost jurisdictions.”

“A good example of a transaction that will capitalize on this trend is our agreement to acquire Triton International, in a $13 billion take private transaction…”

“Triton is the world’s largest owner and lessor of intermodal containers and is a critical provider of global transport logistics infrastructure.”

The transcript discusses the opportunities in renewable power and digitization, as well as the trend of de-globalization. Companies like Intel are moving their manufacturing back to their home countries for critical infrastructure instead of relying on nations like China. Brookfield is investing in this de-globalization by helping companies build out their infrastructure facilities around the world.

An example of this investment strategy is Brookfield’s acquisition of Triton, a publicly traded company that they took private. They note that while critical assets such as chip manufacturing are being brought back to home countries, non-critical items like apparel production are moving to low-cost areas like India. Brookfield has also acquired the world’s largest intermodal container shipper, playing both sides of this trend.

“As we look ahead, we estimate that it will take more than $100 trillion of capital globally to invest across these three themes.”

“We are very well-positioned to capture a meaningful share of this opportunity set…”

“Those secular tailwinds, in addition to an enormous appetite by clients to allocate more capital towards this sector, gives us strong conviction around our ability to more than double our fee-bearing capital in the next five years.”

Brookfield predicts a 15% compounded annual growth rate and anticipates massive investments in these various sectors, creating a potential $100 trillion global opportunity for infrastructure assets worldwide. As they continue growing their free cash flow and distributable earnings, they plan to return capital to shareholders through a 15% annual increase in distributable earnings over the next five years.

High Dividend Growth Stock Opportunity

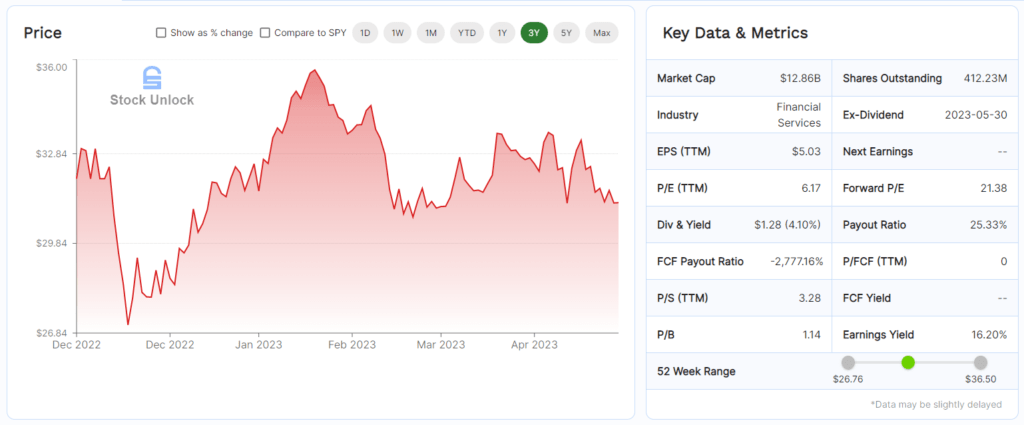

The company currently offers a 4.1% dividend, which is expected to grow at a 15% compounded annual growth rate according to its guidance. This implies that the dividend yield on cost for shares bought today should exceed 8%, nearing 9% in the next five years. Such strong dividend growth makes this stock highly attractive.

Typically, when a company pays a 4% or higher dividend, its growth ranges from 3 to 7%, with the latter being exceptional. Therefore, it’s quite rare for a company to provide both a substantial initial payout and an impressive projected annual increase of 15%. This combination positions it as one of the best and most appealing dividend growth opportunities in the market right now.

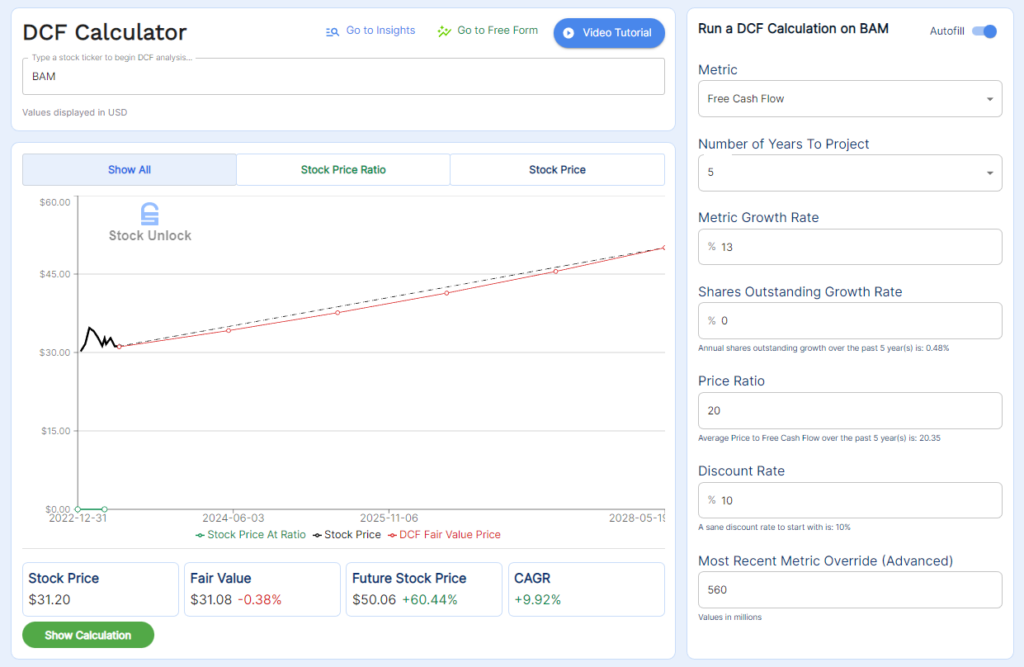

Assessing Brookfield’s Valuation with DCF Analysis

In order to assess Brookfield Asset Management’s valuation, let’s utilize a discounted cash flow calculator and project the company’s free cash flow over the next 5 years. We’ll assume a growth rate of 13%, a trading ratio of 20 price-to-free-cash-flow, and a discount rate of 10%. With these figures, the fair value is approximately $31 per share—similar to its current market price. This indicates that the market expects a compounded annual growth rate (CAGR) of 13% in free cash flow and maintains a 20 price-to-free-cash-flow ratio for the next five years.

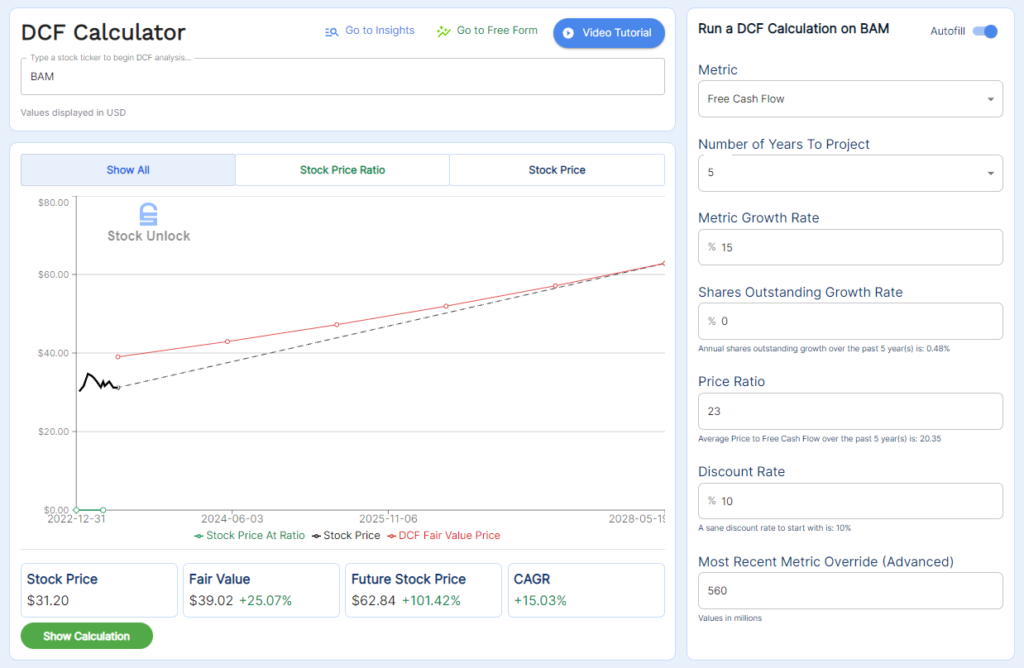

Now, if we increase this growth rate to 15% while maintaining a trading ratio similar to today’s at around 23 price-to-free-cash-flow, then the fair value rises to $39 per share or about 25% higher than where it currently trades. In this scenario, Brookfield should offer an estimated CAGR of about 15%.

It is important to note that these calculations do not take into account dividends; specifically, they exclude Brookfield’s dividend yield which has been growing at roughly 15% annually. Considering both stock appreciation and dividend potential makes Brookfield an attractive investment opportunity.

Therefore, even with conservative estimates on future performance metrics such as growth rates and trading ratios taken into consideration, it seems like Brookfield Asset Management is currently fairly valued by investors.

One thought on “Brookfield Asset Management (BAM) | Best Dividend Growth Stock”

Comments are closed.