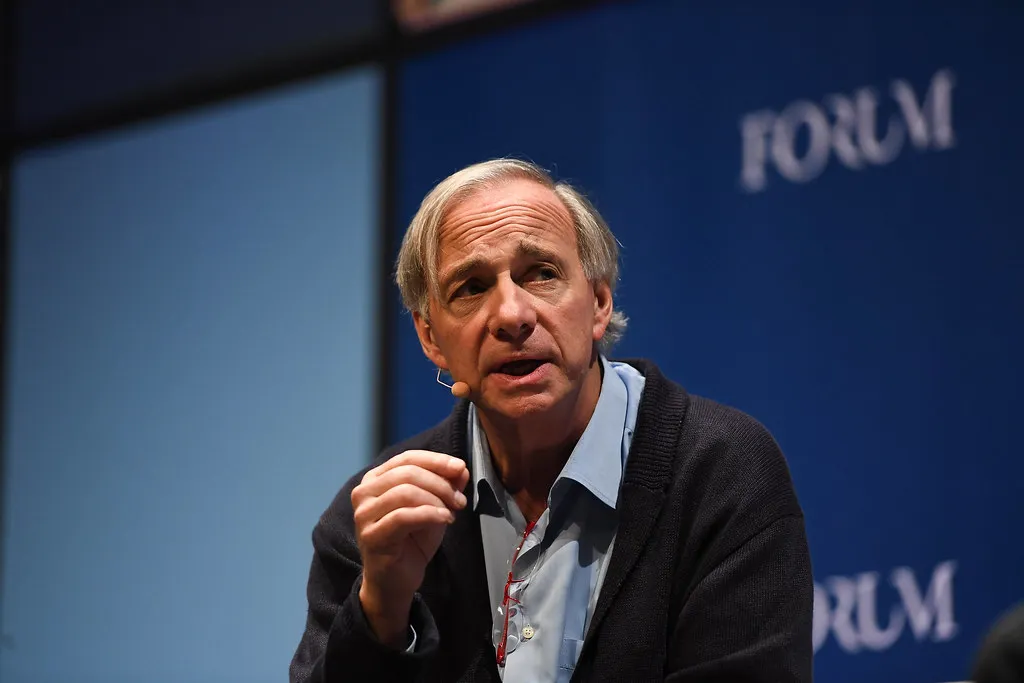

Ray Dalio, the renowned American billionaire investor and hedge fund manager, is the mastermind behind Bridgewater Associates, which happens to be the largest hedge fund worldwide since its establishment in 1975. With a successful career spanning several decades, Dalio has held the position of co-chief investment officer at Bridgewater since 1985.

Despite his humble upbringing in a middle-class neighborhood, he displayed a knack for investing from an early age. Armed with an MBA from Harvard Business School, Dalio took the leap and launched Bridgewater from the comfort of his New York City apartment.

Beyond his financial ventures, Dalio is deeply committed to philanthropy. Through his Dalio Philanthropies, he has generously donated over $1 billion to support various causes, including microfinance and public education.

Ray Dalio net worth in 2023 is estimated to be an impressive $19.1 billion. Dalio’s remarkable journey serves as an inspiration to aspiring investors and showcases the positive impact of his philanthropic endeavors.

Early Life and Education

Ray Dalio was born on August 8, 1949, in Jackson Heights, New York City to a jazz musician father and a homemaker mother. Raised in Nassau County, he learned the value of hard work through various odd jobs like mowing lawns and shoveling snow.

At age 12, he started caddying at the Links Golf Club where he met Wall Street professionals such as George Leib who became his mentor. Dalio made his first investment at a young age by purchasing Northeast Airlines shares for $300 which tripled after the airline merged with another company.

Ray Dalio Net worth in 2023

He continued his education and earned a bachelor’s degree in finance from Long Island University and an MBA from Harvard Business School in 1973. During college, he developed an interest in commodity futures, which offered higher profit potential than stocks.

His journey from humble beginnings to becoming a renowned investor exemplifies how hard work, dedication, and knowledge can lead to financial success. Today’s investors can learn from Dalio’s example as they strive for their own achievements.

Career Insights

After completing his education, Ray Dalio worked in various financial firms before founding Bridgewater Associates in 1975. From his two-bedroom apartment in New York City, the firm steadily grew to become the world’s largest hedge fund by 2005, managing around $160 billion in assets.

Bridgewater’s success is attributed to Dalio’s investment strategies and macro approach detailed in his book Principles. Dalio’s principles prioritize objectivity and understanding market cycles while removing emotions from decision-making for long-term success. This innovative approach has earned him recognition as one of history’s most successful investors, with Bridgewater generating over $58 billion for its clients since inception. His achievements have garnered numerous accolades, such as being named Money Manager of the Decade by Institutional Investor Magazine and induction into prestigious Hall of Fames.

In 2022, Dalio stepped down as co-chief investment officer of Bridgewater Associates but continues to earn income from fees generated through managing investments for clients and charging based on assets under management and performance. Additionally, he profits from personal investments across diverse asset classes like stocks and bonds.

Dalio has also authored several best-selling books including the popular Principles series which contributes further to his income.

Investment philosophy

Ray Dalio has built his fortune by managing clients’ investments in stocks, bonds, commodities, and real estate. His success is attributed to consistently delivering annual returns on these diverse assets.

In 2022, Dalio transferred his majority stake in Bridgewater to the board but retained significant ownership. Though no longer co-chief investment officer, he serves as a mentor within the company.

The firm’s strategies focus on global economic trends and macro investments with holdings divided into two categories: passively managed beta investments that follow market risks and actively managed alpha investments aimed at generating better returns.

Employing quantitative methods for identifying new opportunities, Dalio creates portfolios with diverse risk allocations using algorithms that translate market insights into trades focused on currency and fixed income markets. He pioneered the risk parity approach which combines conventional diversification with market measures for effective risk management.

The specifics of his investment portfolios are expensive and closely guarded secrets known only to a select few within the firm. Dalio’s net worth is expected to remain high in 2023 due to continued success in investing through Bridgewater Associates.

Philanthropic Journey and Impact

Philanthropist Ray Dalio has donated millions of dollars to various causes and established the Dalio Foundation in 2003. The foundation supports education reform, poverty alleviation, environmental protection, health care access, and disaster relief. Dalio has served on boards at Harvard University and the Brookings Institution.

In 2011, he joined the Giving Pledge, committing to donate over half his fortune to charity. By 2012, the foundation’s assets reached $590 million and increased to approximately $842 million after a $400 million contribution in 2013.

Significant donations include support for transcendental meditation research through the David Lynch Foundation and polio eradication projects. Health care initiatives have also been backed by Dalio with contributions made to New York Presbyterian Hospital and a $50 million gift establishing the Dalio Center for Health Justice.

The foundation supports teacher fellowships while funding social entrepreneurs via TED’s Audacious Project. With a special interest in ocean conservation, Dalio dedicates funds towards protecting oceans and supporting research expeditions using his yacht and submarine.

To date, more than $5 billion has been donated by the family into their foundation which granted over $1 billion towards various charitable causes.

Published Works: Economic and Management Insights

Ray Dalio has authored several insightful books on economics and management principles. In his 2007 book, “How the Economic Machine Works; A Template for Understanding What is Happening Now”, he depicts the economy as a machine and examines the relationship between money, credit, debt, and government interventions such as money printing. He also investigates their effects on currency devaluation, interest rates, and asset allocation.

Dalio’s second book from 2017 is “Principles: Life and Work” which focuses on his management philosophy at Bridgewater Associates. It highlights principles and transparent feedback for enhancing performance and decision-making. This bestseller gained significant popularity.

His third book in 2018 titled “Principles for Navigating Big Debt Crises” delves into large debt crisis mechanics by categorizing them into deflationary or inflationary types. Through historical examples and economic contexts analysis of these stages are provided along with lessons to be learned.

In 2021 Dalio released “The Changing World Order: Why Nations Succeed and Fail”; however no further information is available regarding its content or scope at this time.

Ray Dalio’s Major Holdings in 2023

| Stock | Company Name | % of Portfolio | Shares Owned | Value |

| IEMG | Ishares Inc | 5.32% | 17.86M | $ 871.52M |

| IVV | Ishares Tr | 4.59% | 1.83M | $ 751.73M |

| PG | Procter And Gamble Co | 4.49% | 4.94M | $ 735.26M |

| JNJ | Johnson & Johnson | 3.39% | 3.59M | $ 556.05M |

| PEP | Pepsico Inc | 3.12% | 2.81M | $ 511.81M |

| KO | Coca Cola Co | 3.08% | 8.15M | $ 505.25M |

| SPY | Spdr S&p 500 Etf Tr | 3.08% | 1.23M | $ 504.83M |

| MCD | Mcdonalds Corp | 2.62% | 1.54M | $ 430.15M |

| COST | Costco Whsl Corp New | 2.61% | 861.31k | $ 427.95M |

| WMT | Walmart Inc | 2.40% | 2.67M | $ 393.71M |

| VWO | Vanguard Intl Equity Index F | 2.09% | 8.47M | $ 342.23M |

| SBUX | Starbucks Corp | 1.58% | 2.49M | $ 259.06M |

| GOOGL | Alphabet Inc | 1.46% | 2.31M | $ 239.44M |

| V | Visa Inc | 1.36% | 990.82k | $ 223.39M |

| ABT | Abbott Labs | 1.33% | 2.16M | $ 218.59M |

| META | Meta Platforms Inc | 1.30% | 1M | $ 212.32M |

| CVS | Cvs Health Corp | 1.12% | 2.47M | $ 183.83M |

| PDD | Pdd Holdings Inc | 0.99% | 2.14M | $ 162.61M |

| GLD | Spdr Gold Tr | 0.99% | 886.80k | $ 162.48M |

| MDLZ | Mondelez Intl Inc | 0.95% | 2.23M | $ 155.76M |

Famous Quotes by Ray Dalio

Time is like a river that carries us forward into encounters with reality that require us to make decisions. We can’t stop our movement down this river, and we can’t avoid those encounters. We can only approach them in the best possible way.

Every time you confront something painful, you are at a potentially important juncture in your life — you have the opportunity to choose healthy and painful truth or unhealthy but comfortable delusion.

Remember that most people are happiest when they are improving and doing the things that suit them naturally and help them advance. So learning about your people’s weaknesses is just as valuable (for them and you) as is learning their strengths.

Some people go through life collecting all kinds of observations and opinions like pocket lint, instead of just keeping what they need. They have ‘detail anxiety’, worrying about unimportant things.

Don’t mistake possibilities for probabilities. Anything is possible. It’s the probabilities that matter. Everything must be weighed in terms of its likelihood and prioritisation. Believe it or not, your pain will fade and you will have many other opportunities ahead of you.