In January 2024, the Bitcoin ETF started and did very well. In just two months, people put more than $10 billion into it. Bitcoin’s value went up 70% in the first quarter because of these ETFs. Two big events might happen soon that could make the ETFs even better.

If you wonder whether to invest in these ETFs, this article is for you. This article is about which ETFs are good and which ones aren’t.

Bitcoin ETFs

There are about 10 Bitcoin ETFs right now, and more will come later. These ETFs are exchange-traded funds, which act like a group of stocks and have their own ticker symbols. They mimic the return on Bitcoin without people needing to buy it themselves. The fund management company owns the Bitcoin through exchange like Coinbase. Here is a list of those ETFs and their symbols:

| Symbol | Name | Price |

| IBIT | iShares Bitcoin Trust | $ 36.84 |

| FBTC | Fidelity Wise Origin Bitcoin Fund | $ 62.2 |

| BITB | Bitwise Bitcoin ETF | $ 35.28 |

| ARKB | Ark 21Shares Bitcoin ETF | $ 64.2 |

| GBTC | Grayscale Bitcoin Trust | $ 57.55 |

| BTCO | Invesco Galaxy Bitcoin | $ 64.25 |

| EZBC | Franklin Templeton Digital Holdings Trust | $ 37.23 |

| BRRR | Valkyrie Bitcoin Fund | $ 18.33 |

| BTCW | WisdomTree Bitcoin Fund | $ 75.58 |

| HODL | VanEck Bitcoin Trust | $ 80.54 |

ETFs Price Fluctuations

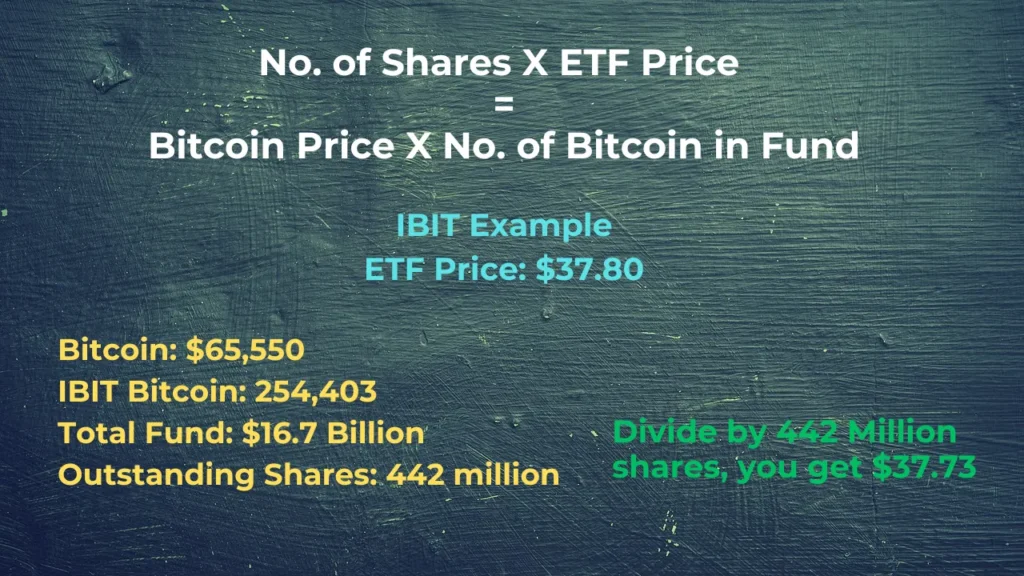

You might wonder why ETF prices change a lot. It’s because of a simple equation. The total number of shares times the price per share equals the price of Bitcoin times the number of Bitcoins in the fund.

Here’s an example: iBit has a price of $37.80. Bitcoin’s price today is $65,550, and iBit has 254,403 Bitcoins. There are 442 million shares. Multiply the Bitcoin price by the number of Bitcoins, and you get $16.7 billion. Divide that by the number of shares, and you get $37.73, close to iBit’s price.

Different ETFs have different prices because they have different numbers of shares and Bitcoins. Some grow more than others over time because of supply and demand in the ETF. However, all these Bitcoin ETFs will start to level out with one another soon.

Now that the first wave of buying is over, these funds will likely follow Bitcoin’s value. At this time, it is not possible to guess how people will react, which might cause changes in demand. But soon, these funds should have similar returns. When choosing an ETF to buy, the performance won’t be very different, so it won’t affect your choice too much.

Evaluating Bitcoin ETFs

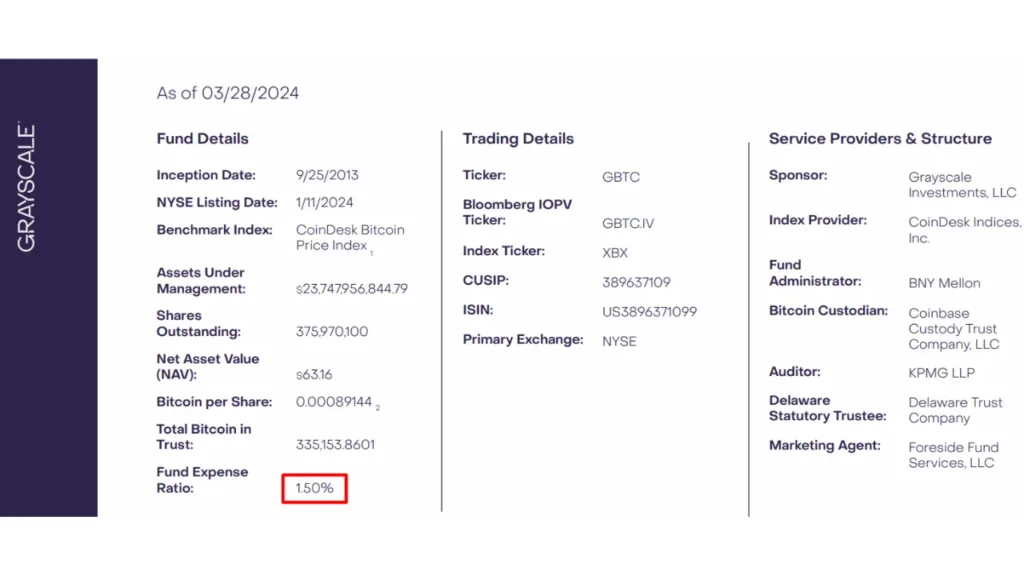

Now, what are the top 3 things to look for in a Bitcoin ETF? First, look at the expense ratio. For example, Grayscale Bitcoin Trust (GBTC) has a high expense ratio of 1.5%. They say it’s because of their experience, though it seems the reason is pure greed. Since it’s only one asset, Bitcoin, the fees should be very low. It would be wise to choose an ETF with lower fees.

Next, think about who is holding the Bitcoin. Most funds use Coinbase for buying and keeping their Bitcoin. There might be some risk because Coinbase is a third party. Two funds are different: VanEck and Fidelity Fund. VanEck uses Gemini, but they are smaller than Coinbase, so they could be riskier. Fidelity Fund keeps their own Bitcoin, which might be safer than others.

Lastly, check the average volume and market cap of the ETF. This shows how easy it is to sell if you need to. If a fund has very low volume and a small market cap, like the WisdomTree ETF, you may not want to buy it.

The iShares Bitcoin Trust and Grayscale ETF are both popular. But the Grayscale ETF, with its high fees, has lost money recently. At the same time, more people are putting money into the iShares Bitcoin Trust. This is probably because it has lower fees. So, some people who had the Grayscale ETF might be switching to the iShares Bitcoin Trust. These three things help us decide which fund to choose.

ETFs List as per the Criteria

The below ETFs list is made when these ETFs are ranked based on three things: expense fees, volume, and market cap. The Grayscale ETF is ranked lower because its fee is too high. People might definitely would want to sell it and buy a lower fee ETF, making Grayscale’s price drop. The VanEck ETF appears at the bottom of the list because it has both low volume and market cap, and also the Gemini is the custodian.

| Symbol | Name | Price | Fee | Custody | M. Cap | Volume |

| FBTC | Fidelity Wise Origin Bitcoin Fund | $62.2 | 0.25% | SELF | $7.16B | $0.40M |

| EZBC | Franklin Templeton Digital Holdings Trust | $37.3 | 0.19% | Coinbase | $342M | $0.42M |

| BITB | Bitwise Bitcoin ETF | $34.88 | 0.20% | Coinbase | $2.2B | $3.2M |

| ARKB | Ark 21Shares Bitcoin ETF | $64.23 | 0.21% | Coinbase | $3.1B | $3.2M |

| BTCW | WisdomTree Bitcoin Fund | $75.58 | 0.25% | Coinbase | $81M | $0.42M |

| BTCO | Invesco Galaxy Bitcoin | $64.31 | 0.25% | Coinbase | $414M | $0.74M |

| IBIT | iShares Bitcoin Trust | $36.47 | 0.25% | Coinbase | $16.8B | $37.5M |

| BRRR | Valkyrie Bitcoin Fund | $18.14 | 0.25% | Coinbase | $537M | $0.5M |

| GBTC | Grayscale Bitcoin Trust | $56.92 | 1.50% | Coinbase | $23.3B | $18.3M |

| HODL | VanEck Bitcoin Trust | $80.54 | 0.20% | Gemini | $596M | $0.5M |

Some might ask why not just buy Bitcoin instead of an ETF with fees? Most people have their money in IRAs or 401ks, where you can’t directly buy Bitcoin. The only option is a Bitcoin ETF. However, if you have a self-directed IRA, you can buy Bitcoin directly.

Bitcoin ETFs Growth Opportunities

Now, let’s talk about good news for Bitcoin. There are two big events happening with Bitcoin and Bitcoin ETF soon that might make Bitcoin investment grow even more.

First, in mid-April, Bitcoin is cutting its mining reward in half. This happens every four years. It may sound strange, but it’s because there will only be 21 million Bitcoins. In the past, when this happened, the price went up, but we can’t be sure.

Next, in 2024, China might approve their own Bitcoin ETF. This could add $5 to $10 billion to the Bitcoin world. When the US did this, the price went up and it made Bitcoin more stable and trusted.