The stock market is going wild, and many people think it might have a big change soon. This often happens when the Federal Reserve talks about interest rates. People wonder if they should buy stocks now, but is this the right time? The stock market lost a lot of money this week, and many safe stocks went down $30,000. Cryptocurrency Bitcoin dropped too.

Tech stocks like Tesla are not doing well either. We found out that inflation was actually much higher than we first thought in 2022. Also, CEOs have been selling lots of their company stock, and the IMF warned the US about our debt. People thought interest rates would be lower by now, but they’re not.

Some people are scared of the stock market because of all this news. There’s a lot of bad news about the economy that makes people worry. Some reasons are good, some not so good. One big reason people are scared is because they fear war or global conflict.

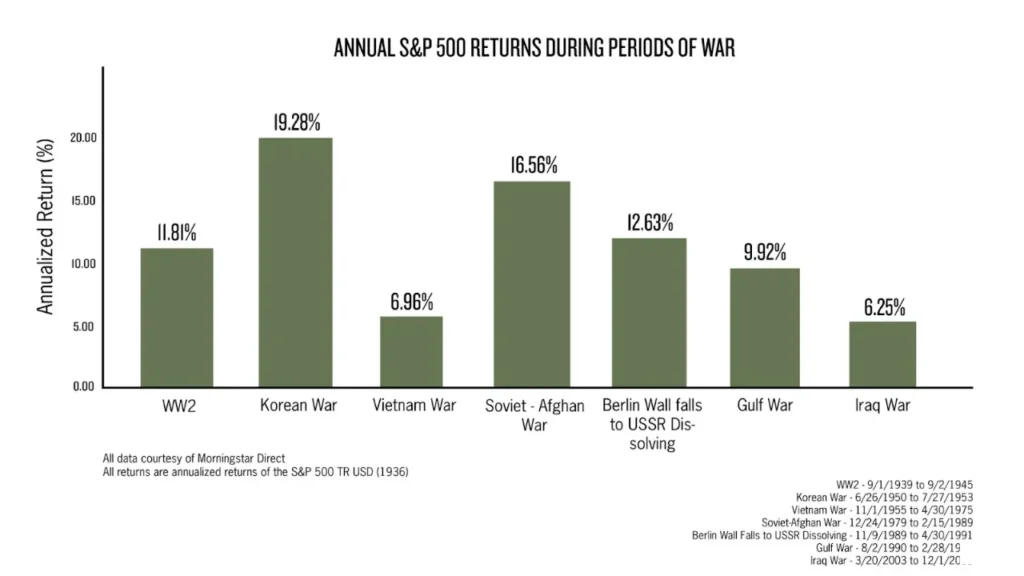

Geopolitics can sometimes scare the stock market because it doesn’t like surprises. But, war can also make some people rich. Since 1939, big wars have helped the stock market grow by about 11%.

Other reason why people might sell stocks after tax season is to lower their taxes. This is called tax loss harvesting. Some people also sell stocks when they see important people, like CEOs, selling their own stocks. Headlines might say things like “Jeff Bezos sells $2.4 billion of Amazon stock” or “Mark Zuckerberg sells half a billion dollars of Facebook.”

These headlines can scare people, but they might not be what they seem. For example, Jamie Dimon and Mark Zuckerberg both planned their sales a long time ago. Jeff Bezos did sell Amazon stock recently, but maybe he just wanted to buy fancy things like mansions and a big boat. Jeff Bezos said in November 2023 he wanted to sell. He is selling to pay less taxes. He will move from Washington to Florida to be near his parents. This lowers his 7% tax. He doesn’t think the economy is bad.

In short, there are many reasons why people might sell stocks. Don’t always believe scary headlines. This is misdirection. These are not the real reasons.

There are other reasons to be worried. There are three big problems. Problem one is inflation, which means prices go up fast. We want it to be at 2%, but right now it’s 3.8%. That’s twice as high as we want.

Problem two is the interest rate. It’s very high to slow down inflation. But even with a high interest rate, inflation isn’t slowing down. That’s not good.

Problem three is the national deficit. The US is spending and borrowing more money than it has. This is a huge problem, so much that the International Monetary Fund warned us about it. By 2025, the US will have a spending deficit of 7.1% which is much higher than other countries’ average of 2%.

These three problems make the stock market go up and down and lose value. Even if we can fix these problems, it feels like we’re stuck in a puzzle, waiting for someone to save us.

Here’s a way to understand the stock market. The government can print more money, but it’s not that simple. When the US needs money, it uses treasury bonds. People buy these and earn interest. Treasury bonds are very safe because the US government backs them.

But there’s a problem. Nobody wants to buy bonds when the stock market is good. It’s about risk. To get people to buy debt, government offers more money by raising interest rates. It’s like a high dividend stock. This is how they get people interested.

But government can’t raise interest rates because it’s too expensive. They already have a big spending deficit. So, can’t lower them either. Lowering interest rates helps consumers and investors, but it hurts low-income Americans.

There are three possible outcomes: hard landing, soft landing, and no landing.

A hard landing means keeping interest rates high to fix inflation, even if it causes a recession and job loss. 7% of economists believe this will happen.

A soft landing means our current path will lead to 2% inflation without job loss. 54% of economists believe this.

No landing means we won’t lose jobs or reach 2% inflation soon. The economy keeps growing at a certain rate. 36% of economists believe this.

But it’s difficult to guess when the market will change. However, there still seems to be a 96% chance interest rates won’t change. This means stocks may struggle until the Federal Reserve decides to lower interest rates. They might do this because elections are soon. The Fed says they don’t get involved in politics, but they might.

All assets make money, but average investors do worse because they get scared and sell when they hear bad news. Still some people will be right and make millions, but it’s not always because they knew what would happen.

There are people who invest in the S&P 500 and buy blue-chip dividend stocks that are boring. There are also people who buy Bitcoin as a backup plan. No one knows everything about the economy.